What is the bane of small B2C companies who advertise on Google Shopping?

It’s probably Amazon. Or another distributor. Maybe more than one!

Do they carry a product similar to yours? Likely yes.

Is the shipping or price cheaper than yours? Quite possibly yes.

But—and this is the big one—can you still compete with them?

Definitely.

When it comes to outsmarting your Google Shopping competitors, you can’t treat it like Google Search. After all, you don’t have keywords or ad copy. But even with the rise of automation, there are still ways to optimize and win—especially against big companies who have a lot more things to pay attention to than you do.

Step 1. Segment your products.

You can gain data insights for collection and comparison by separating your products into different ad groups—not just product groups. But this isn’t a surefire win for every account. You need to have a small enough catalog to pay attention to individual performance.

While it may not work for every case, there is a balance.

If the ad group is too small, then automated bidding won’t have enough data. If you go too granular, you may not have enough time to optimize each group. But, if you go too big-picture then you lose analytical capability.

In general, if you have a smaller group of products or high sales volume relative to the number of products, then try separating your products into ad groups.

If you have a larger amount of products, this is just one of multiple strategies.

What’s the difference?

Product groups:

- Can set individual bids and groups in any way you want.

- Created directly from products in the feed, within an ad group.

- Good for when you have too many products to handle personally, or when individual products have low sales volume.

Ad groups:

- Can use the Overview tab to view and sift through data.

- Contain whichever feed products you decide to place in it.

- Let you set the “priority” of all contained groups, meaning you can play with more advanced strategy.

- Good for both small optimizations and knowing for sure what is and isn’t performing. Especially important for a small budget.

How should you differentiate the campaigns and ad groups?

There are a few different ways to segment your campaigns and ad groups. Choose the most relevant differentiators that set your products apart or that reflect your overall goals.

Consider:

- Profit margin: when you have fewer, higher-profitability products.

- Sales volume: when you need to sell a lot of products.

- Individual product: when you have only a few products that individually matter.

- Type of product: when you have many products in distinct groups.

- Different target market: when you cater to more than one audience.

- Product price: when your products vary significantly in price.

For example, if your entire store focuses on one target market and everything has a similar price, then you may want to focus on simply selling the most products.

- Consider campaigns broken up by sales volume to ensure your highest-volume products have a separate budget from your lower-volume products.

- Break up ad groups by product price or profit margin to get more detailed data on a metric that is relevant to your long-term goals.

On the other hand, if your company sells a large variety of men’s and women’s products of all kinds, and has high sales volume, then make sure you set yourself up to gather data on all of your products.

- Break up campaigns not only by men’s and women’s products, but also by sales volume or profit margin. This means you will have many campaigns to keep track of, but you can effectively prioritize your most important products.

- Break up ad groups by type of product, so you can differentiate between different categories’ performance.

- Or, break up campaigns by type of product and sales volume or profit margin, then break up ad groups by men’s or women’s.

Step 2. Fix any “money sinks”.

Some products spend large amounts of money but rarely convert. If your account has one (or several!) it will be immediately obvious upon viewing the data.

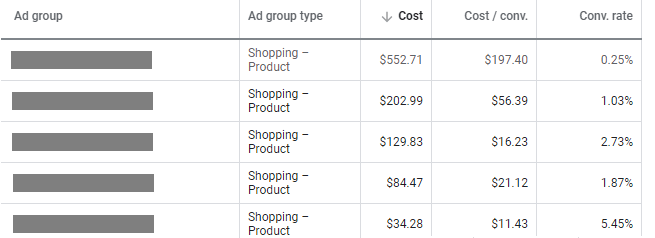

For example, try identifying the money sink in this campaign.

Why would this happen?

Sometimes products with very interesting or eye-catching pictures can draw more than their share of clicks. Usually, having an interesting picture is good. However, if the product is particularly niche and there is a mismatch between expectation and reality, these clicks can waste a lot of money.

What do you do?

If you see that one ad group or product group is spending more than their share of money but not improving ROI, you only have two immediate options in Google Ads.

Option 1:

- Pause the ad group or exclude the item(s) from your product feed.

- This will mean the product doesn’t run. In situations where you have no extra budget to allocate, then you may have to do this. However, by preventing the product from running, you lose the ability to test improvements to performance.

Option 2:

- Put the product(s) into their own campaigns.

- This will allow you to directly control how much money is spent promoting this product. If it does convert and you can afford to give it enough budget, this is a good solution for letting it run but keeping it on a leash.

Neither of these are great long-term options.

For further troubleshooting, consider:

- Comparing landing page terms with the Search Terms report to look for keywords that bring in unqualified traffic.

- Adding & analyzing audiences to see if specific groups have a high number of clicks but are unlikely to convert, so that they can be excluded.

- Inspecting the product data feed for inaccurate attributes that could lead the product to display to the wrong demographics.

Step 3. Examine and compare your data to competitors’ to only compete where it matters.

Once your campaigns are set up to gather effective data, you can begin using the hard numbers to your advantage on top of automation. To most effectively compare your performance to Google Shopping competitors, you need enough activity to view the detailed Auction Insights Report.

Here’s where you start to pull together numbers and charts. Stick with one campaign or even ad group at a time—otherwise, it can get complicated.

For example, say you have an ad group containing a single menswear product from your small company.

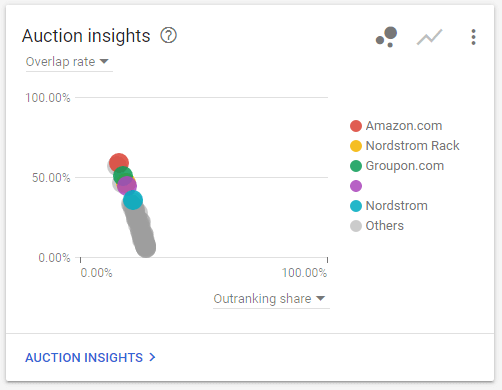

If you go to the Overview tag and look at the Auction Insights > Overlap Rate to Outranking Share, you can see which Google Shopping competitors’ ads show up when yours do.

It looks like we’re often showing up at the same time as Amazon, Nordstrom, and other large companies. Worse, their ads usually show up above ours.

The secret is, that doesn’t matter.

You don’t beat a giant by fighting head-on; you beat them by finding your own niche.

Pay attention to something else: where you should, and shouldn’t, be competing for space.

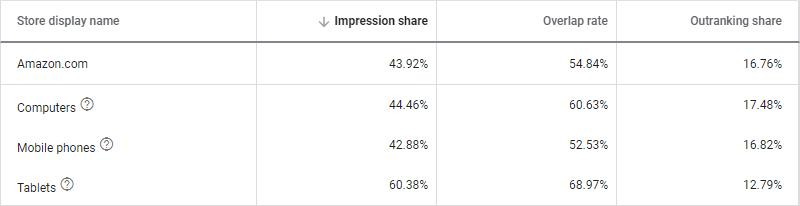

Because in the auctions that you and Amazon are competing, take a look. Your overlap is 8-16% higher on tablets and computers. In fact, your products are most likely to outrank Amazon’s when they show on computers.

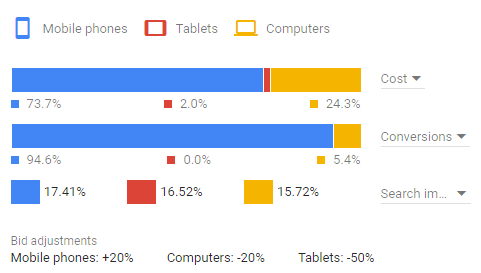

But how valuable are those placements to you? Check the Overview tab’s Devices card.

As it turns out, not so valuable.

So why are we wasting time competing with Amazon for placements that waste your money? Let’s bid down on those placements for this ad group.

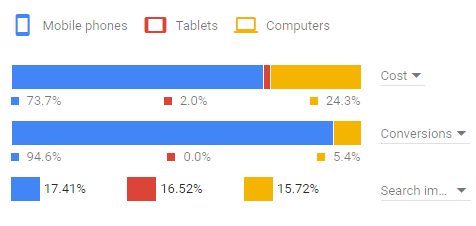

And when we look at the previous image, we see something else: it looks like mobile phones are a disproportionately valuable placement for this item. In fact, we’re spending far less on it than we could, and it’s the placement that Amazon has the least impression share in—so we’re less likely to be competing with that industry giant at the same time that we bid on our most valuable placement.

Let’s bid up on mobile phones to compete in the auction that’s actually relevant to our success.

Maybe your Devices card will end up looking like this:

Give it at least two weeks to gather data, then compare performance and find another opportunity for improvement.

Competing with industry giants in Google Shopping is never easy, but small eCommerce companies can succeed by finding niches that their larger competitors aren’t paying attention to. Your advantage is being able to pay attention to the small details, so make use of it! Contact us if you need help with Google Shopping Management!